Is Now The Time For Value Stocks?

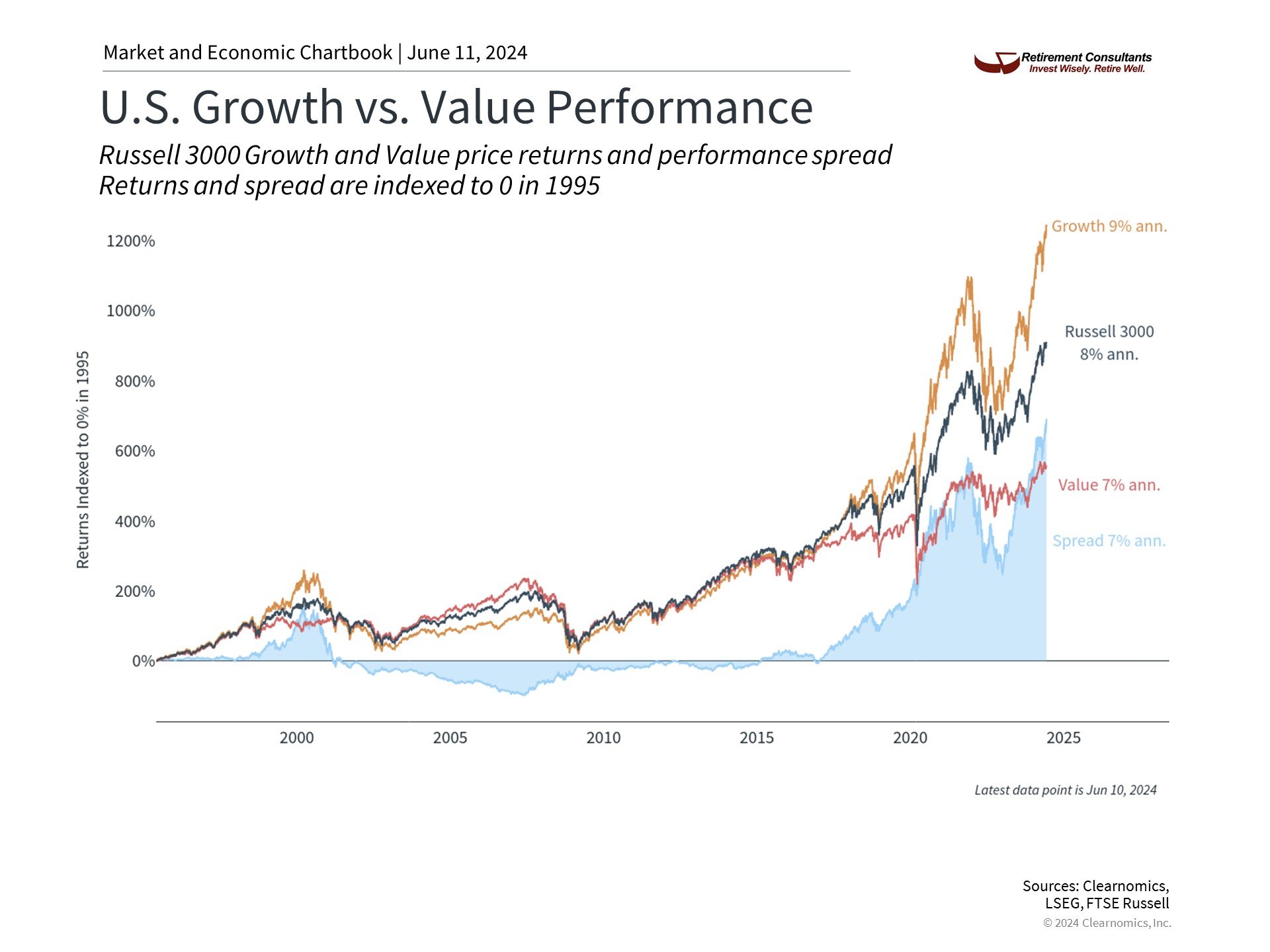

Growth stocks have outperformed value stocks in recent years, is this reversing?

As a seasoned financial consultant, I find myself squarely at the crossroads of market trends and investor sentiment. The tug-of-war between growth stocks and value stocks has been a captivating saga, and lately, the winds are shifting. Let’s delve into the dynamics and explore whether now is the moment to embrace value stocks.

The Rise of Growth Stocks

Over the past decade, growth stocks have been the darlings of Wall Street. Companies with explosive revenue growth, disruptive technologies, and sky-high valuations have dominated headlines. Investors flocked to these high-fliers, chasing the promise of outsized returns. Think FAANG (Facebook, Apple, Amazon, Netflix, Google) and their meteoric rise.

The Value Stocks Dilemma

Meanwhile, value stocks — often overlooked and under appreciated — have languished in the shadows. These are companies trading at a discount relative to their intrinsic worth. Think mature industries, established players, and steady dividend payers. Sectors like energy, financials, and basic materials fall squarely into this category.

A Reversal of Fortunes?

Over the past decade, growth stocks have significantly outperformed value stocks, driven by the strong performance of technology companies and low interest rates. But wait! The significant valuation gap between growth and value stocks suggests a potential for mean reversion. Value stocks are currently trading at historically low valuations relative to growth stocks, which may provide an opportunity for outperformance. In recent months, there has been a noted rotation from growth to value stocks as investors seek to capitalize on economic recovery and hedge against inflation.

As a financial consultant, I advise my clients to look beyond the headlines. While growth stocks have dazzled with their exponential gains, they also carry higher risk. Valuations can defy gravity for only so long. Meanwhile, value stocks offer stability, dividends, and a margin of safety.

The Bottom Line

Timing the market perfectly is a fool’s errand, but recognizing shifts in sentiment is crucial. Value stocks are no longer the wallflowers—they’re stepping into the spotlight. As a financial consultant, I advocate for a balanced approach. Blend growth and value, diversify across sectors, and stay attuned to the deeper currents beneath the market’s surface.

Remember, investing isn’t a sprint; it’s a marathon. And sometimes, the tortoise wins.

The views expressed in this blog post are for informational purposes only and should not be construed as personalized investment advice. Consult with a qualified financial professional before making any investment decisions.

US Growth vs Value Performance